|

Sub-p rime D ebacle2:2 T3h e Greed and Folly of i-Banks Brought the Entire World Economy to the Brink of Catastrophic Collapse.

B. K. Sharma

Electronics & Communication Department

National Institute of Technology

Patna-800005, India.

e-mail : bijay_maniari@rediffmail.com

Abstract:

September 2008 saw the complete collapse of the Major Investment Banks in US. The collapse of US financial system led to the freezing of inter-bank loans globally. As a result Investment Banks world over are heavily loan ridden and with too little capital to continue with their day to day transactions. This has led to Global Credit Crunch which in turn has led to mounting bankruptcies of small firms, reduction in production activities, layoffs and sharp fall in share price index. The main trigger of this rapidly spreading economic malaise of credit crunch was the issuance of home loans to people with no income-no job-no no-assets. These were called NINJA loans. These NINJA loans were converted into Mortgaged backed Securities and these MBS were insured as Credit Swap Obligations(CSO) making them 100% failure proof. These insured MBS were offered as the safest investment bonds for Global Investors who originally invested in US Treasury Bonds. But after 9/11 , 2001, twin-tower catastrophe the return on the these Government Bonds were reduced to 1% and in its place Commercial Banks were allowed to trade in MBS and in CSO. These had a good rate of return of 4-6%. These naturally attracted the world wide investment from LIC and pension funds and their likes. This created a great demand for Securities Bonds and hence a speculative housing bubble was created by recklessly granting NINJA Home Loans and issuing Securities Bonds as an instrument for safe and remunerative investment. By 2006 when equal monthly instalments (EMI) became due the NINJA loanees started defaulting and walking away from their mortgaged houses leaving the i-banks with almost 1 million foreclosures and 1 million forfeited houses. The i-banks could not even recover the loan by the sale of the confiscated houses because there was no taker for the same. This became known as sub-prime housing loan debacle which spread panic in the securities market and then in share markets leading to a colossal credit crunch and the subsequent shrinkage in production activities and massive layoffs which is rapidly snow-balling into a major global economic crisis. Right now US Government, European Governments and all other Governments have no option but to inject equity capital in credit starved banks and underwrite their to the days of 1934 Great Depression. Inter-banking lending was completely frozen and today it continues to be frozen. Foreign Institutional Investments have been busy offloading their shares and taking out their investments from India. They have taken out $10billion equity capital from the Indian Market. But this has badly shaken the investors confidence in share market leading to serious credit crunch and fall in Indian Share Prices. In fact Share prices all over the Globe had a drastic fall. All this has led to a colossal credit crunch leading to shutting down of businesses, unemployment and recession rapidly becoming depression. In last two years, 1 million became homeless with foreclosures mounting relentlessly. In USA from Jan to August 2008 there were 610,000 jobless and in September alone 159,000 jobs were lost.[2]

GENESIS OF THE FINANCIAL CRISIS: A. 1933 Glass-Stealgall Act and its undoing:

After the First World War, there was rapid economic development in USA because the countries most effected by the just concluded war were European Countries. But soon the bubble of development popped out and the Great Depression of 1934 set in USA and the continents. Howard Hoover, the then President of USA, lost massively in Presidential Election and President Roosevelt became the President in those difficult times. He introduced “REGULATION MEASURES” to check the unfettered capitalism which tends to be speculative, parasitic rather than productive. This regulation is known as 1933 Glass-Stealgall Act. This separated commercial and investment banks. It also set up the system of Federal Regulation of the work of the financial sector. Under this Act, House of Morgan was split into Morgan Stanley i-bank and J.P.Morgan c-bank.

In 1944, 730 delegates from all 44 allied World War Nations met at Mount Washington Hotel in Bretton Woods in New Hampshire. The occasion was UN hosted Monetary and Financial Conference. At this conference Bretton-Wood System of Global Management was created. This was the system of rules, institutions and procedures that regulated the international monetary system. Under this international monetary system, International Bank of Reconstruction & Development (IBRD) and International Monetary Fund(IMF) were created. It irrevocably broke down in 1971 when US suspended convertibility of Dollars into Gold. In effect DOLLAR became the reserved currency for all Nations.[3]

In 1970 when Richard Nixon Administration tried to undo 1933 Glass-Stealgall Act, US Supreme Court had warned against this move. In 1990 Federal Reserve Chairman Allan Greenspan allowed J.P.Morgan(c-bank) to issue securities or what is world market so i-banks sensing a big potential global securities market , in 2004 they very consciously and methodically created the speculative housing bubble. NINJA took new loans from investment banks to refinance the house loans at low interest rate. The i-banks issued security bonds to general public to finance these NINJA loans at low interest rate. These are MBS. This led to heavy demand of houses leading to inflation in house prices. House Inflation led to general inflation. In 2006 interest rates on inter bank loans started increasing due to general inflation and principal repayment holiday was over. So suddenly instalments of loan repayment sharply shot up. NINJA loanees defaulted leading to confiscation of mortgaged houses. Almost 1 million houses were confiscated and put up for sale. There was a glut of houses in the market and house prices rapidly depreciated. This rapid depreciation made house MBS worthless. Because of this $850 billion worth of MSP out of $13 trillion could not be honoured. This led to Bear Sterns being bought by J.P.Morgan, Merril Lynch being bought by Bank of America , Lehman Brothers being declared Bankrupt and American Insurance Group being nationalized just as Northern Rocks in Britain was nationalized in UK in early 2007. Fannie/Freddie was nationalized at a cost of $100 billion.

Because of lack of confidence in securities , not only house MBS, but all kind of securities have lost credibility. Toxic assets first effected the securities market. This effected the share market. This in general effected the whole of Global Economy. i- |

|

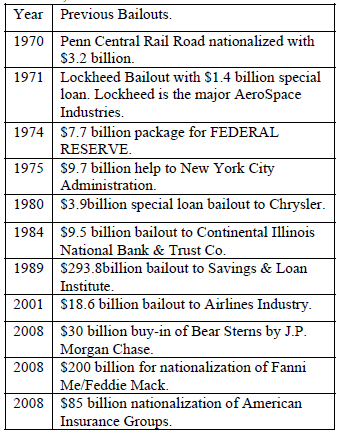

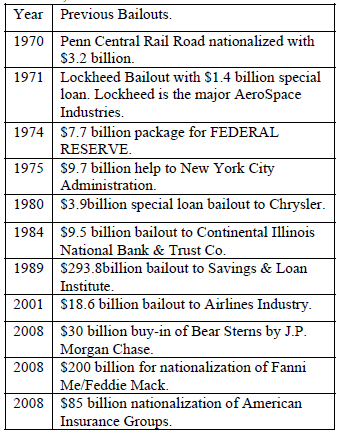

bad loans by subsidizing it with Government Bail out packages and this precisely Britain did and all major Central Banks including US followed the cue. This is not the first time that US had to bail out an ailing enterprise. Till now there have been 8 bailouts in the period 1970-2001. In 2008 there have been 5 major bailouts and many more are to follow. If the governments have to keep socializing the losses then there is no reason why the profits should not be socialized. Under the circumstances all large scale production units which can be professionally managed must be nationalized without any delay. Only small scale production units and services which require the special acumen of different category of traders, artisans and business men and which need to be owner managed should continue under private ownership.

INTRODUCTION:

In last one month the five major free-standing ibanks (investment banks) that stood on the top of the mighty financial sector of US came down tumbling like a house of cards and this all happened in the month of September 2008. BEAR STERNS became financially untenable and it had to be bought by J.P.Morgan Bank. On 15th September LEHMAN BROTHERS declared bankruptcy because its shares fell from $65 per share to 5 cents per share. MERRIL LYNCH could not maintain its credit worthiness and was sold to BANK OF AMERICA for $50 billion. AMERICAN INSURANCE GROUP, mortgage giant, had to be rescued by nationalization. MORGAN STANLEY & GOLDMAN’s SACHS stocks lost all their values and have opted to operate as Commercial Banks(c-banks) and accepted the supervision of Federal Reserve and Security and Exchange Commision.[1] . Even earlier Fannie/Freddie’s Morgatge Backed Securities Business was nationalized at a buyout of $100billion. These five failures led to shock waves through the global finance market. The worries about toxic assets and bad Mortgaged Backed Securities(MBSs) spread from the financial Sector to the credit market and from the credit market it is spreading out to the broader economy. The Dow Jones Share Prices had the steepest fall since 9/11 event. It seemed the wheel of history has made one full turn and we were back popularly known as Mortgaged Bank Securities(MSBs). In 1996 the investment activities snowballed to 25% for the c-banks. In later part of 1996, Head of Travellers’ Insurance proposed merger of Travelers(i-bank) and CitiBank (c-bank) without repealing the Glass-Stealgall Act. This merger did not go through. So eventually in November 1999, Texas Republican Senator Phil Gramm pushed through the repeal of 1933 Glass-Stealgall Act. Along with the repeal , Commodity Futures Modernisation Act 2000 was passed which created the Shadow Banking System. This was Corporate Welfarism at the worst and dawn of Crony Capitalism. This repeal of 1933 Glass-Stealgall Act pitted the securities companies and insurance companies to compete against each other. This was a major factor leading to speculative housing bubble.

This repeal allowed c-banks to freely create and trade in MBSs and in Collateralised-Debt Oblligations(CDO). Ralph Nader, the consumer advocate, was perpetually blowing the whistle against mismanagement of MBSs.[4,5]

B. 9/11 event and reduction in the rates of US Bonds.

Before 9/11 US Bonds were the safest investment Bonds in Global Investment Market but after 9/11 its rate of return was reduced to 1% thus making these investments very unremunerative. So Global Investors turned to more remunerative securities which were provided by the financial players such as Bear Sterns and Lehman Brothers. As the demand for the securities bonds mounted the need for creating new securities bonds arose. US Banks gave out House Loans indiscriminately to people with NO INCOME NO JOB & ASSETS. This was called NINJA Loans. There was no down payment involved and there was a holiday of 2 years, starting from 2004, in the repayment of the principal amount. The logic behind these unsustainable loans was that in the event of default they could realize the total amount through resale of the mortgaged house. The excessive demand of houses led to real estate inflation which led to inflation in general. In 2006 when the moratorium on the loan repayment was over Equal Monthly Instalment (EMI) on house loans sharply rose. This caused a series of default and forced foreclosures. The seized houses were in excess of demand therefore their prices fell. This led to the popping of the speculative house bubble.

C. The consequences of the bursting of Speculative House Bubble. Just as we have Stock Market we have Mortgaged Backed Security(MBS) Market in USA. The MBS are issued by 8400 federally insured Institutions holding $13 billion worth of Net Value Assets(NVA). NVA keeps rising as long as mortgages are appreciating and inter-bank loan interest rates are low. As we have pointed out above that the US Security Bonds were at premium in the Banks built fancy derivative packages and in effect facilitated billions in trading these securities and investing in these low quality loans. Hedge Funds, pension funds and insurance companies funds got lost in the securities market. This caused serious shrinkage in productive activities which has led to high unemployment rate which is leading to serious reduction in demand and hence further shrinkage in productive activities.[6] This depressive scenario has hit the stock market so bad that Laxmi Mittal Enterprises has lost 16.6 billion British Pounds in Share Prices and Anil Agarwal’s Metal Empire has lost 2.7 billion British Pounds in Share Prices.

NEOLIBERALISM LAID THE FOUNDATION OF REPEAL OF 1933 GLASS-STEALGALL ACT [7].

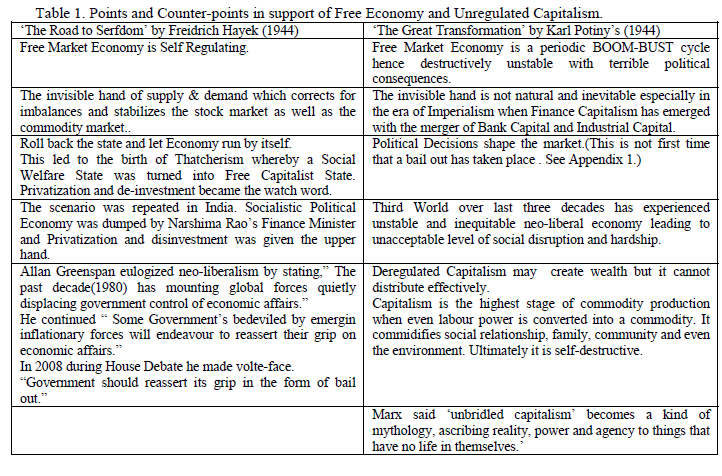

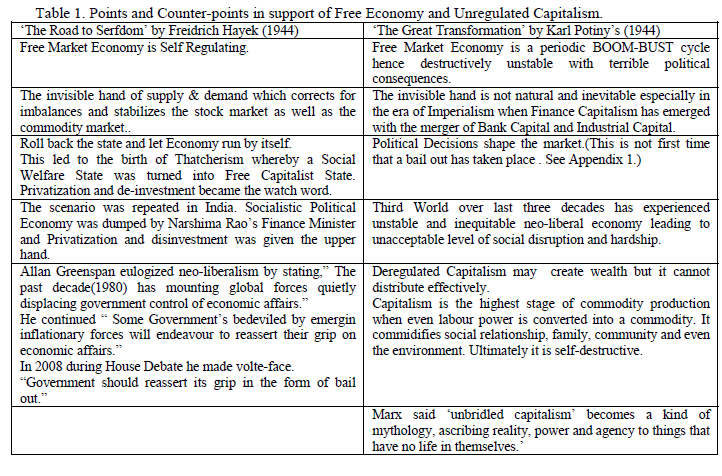

Since the end of Second World War, there has been a continuous debate regarding the free market and unregulated free competition on one hand and planned economy and regulated capitalism on the other. The two view points have been put forward by two idealogues of 20th century. The following table gives the argument and counter-argument for the two sides.

It was the vigorous advocacy of neo-liberalism which resulted in the repeal of 1933 Glass-Stealgall Act and irrevocable break-down of Bretton-Wood System of Financial monitoring. |

THE EFECT OF GLOBAL CREDIT CRUNCH IN INDIA.[9, 10]

The Global Credit Crunch has led to the flight of FIIs (Foreign Institutional Investors) They have offloaded their shares worth $10 billion hence share prices have sharply dropped in Indian Stock Market. Drying up of Foreign Credit Markets has had serious repercussions on Indian Company tapping international market for debt and equity.

There has been all round decline in Capital inflows into Indian Market. Balance of Payments is seriously effected because of downturn in exports. Rupee has depreciated to Rs 49 per dollar. There is declining Asset Prices. Current Account Deficit is widening. All these factors are threatening macroeconomic stability.

To overcome the Global Credit Crunch, Indian Govt has twice reduced Credit-Cash Reserve Ratio by 0.5% from 9% to 8% thereby releasing Rs40,000 crores liquidity in the market. RBI has released Rs 200 crores for mutual funds. SEBI has relaxed the guide lines on Perticipatory Notes to encourage Foreign Institutional Investors.

THE REMEDIES FOR SUBPRIME DEBACLE

“ A sad day for Wall Street, but it may be a glorious day for democracy. Hopefully Congress will now devise a plan that is not based on trickle-down economics. A plan that identifies the real sources of the problem and does something about them-a real |

|

stimulus to the economy, a real programmes to stem the flood of foreclosures and a transparent programme for filling the holes in bank balance sheet. A plan that assures U.S. taxpayers the costs will be borne by those who created the problem. Accountability means paying for the full consequences for one’s action- and the financial system has much to account for.”[10]

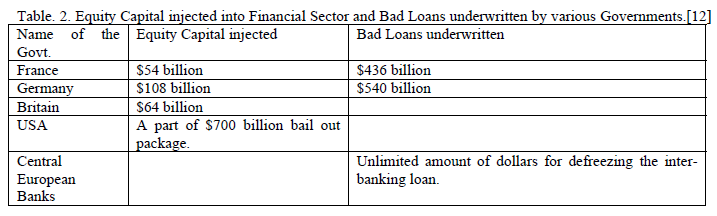

US Government till yesterday was talking about buying the toxic MBSs. In its place British Government has proposed and implemented buying the equity shares thereby injecting equity capital in a financial sector which has too much bad loan but too little capital to go about the business. British Government is also talking about guaranteeing the bad loans. This guarantee will defreeze the inter banking loans. The European Government has followed suit and US Government has also fallen in line.[11]

Indian Government has reduced Cash Credit Reserve to 6.5% thereby releasing Rs 1,45,000 crores in Banking System. RBI has injected Rs 20,000 crores liquidity in Mutual Funds. Both these steps have had a positive effect on the share market. SENSEX have risen by +174.31 points to Share Price Index at 11,483.40 on Tuesday 14th October 2008. The same day NIFTY rose by +27.95 to 3518.65 Share Price Index.

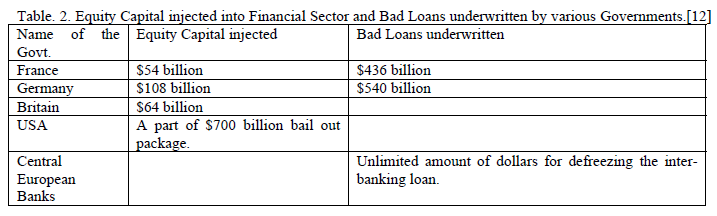

Table 2. indicates the Government efforts to pump equity capital in Financial Institutions and their magnitude of guarantee of bad loans. |

Some of the other recommendations are the following:

(1) A massive direct government fiscal stimulus in form of increased government spending in the infrastructure, unemployment benefits, tax rebates to lower income house holds and provision of grants to cash-strapped local bodies.

(2) An agreement between creditor countries running current-account surpluses and debtor countries running current- account deficits and a recycling of creditors’ surpluses to avoid disorderly adjustment of such imbalances. China has $2 trillion dollar reserves with which US such a way that supply closely follows the demand. No government planning or intervention is required. But historical materialism has proved that Capitalism is marked with very unequal development- unequal development of urban and rural, industry and agriculture and between mental and manual. Wherever the rate of return is higher, wherever there is higher profitability that domain of production, that geographical area and the kind of people with specialized and very profitable skills are bound to develop faster than others. In such situations of uneven growth if government does not plan and does not consciously invest then those areas will remain backward for time eternity.

Historical Materialism has also proved that successful countries like USA, Japan, Germany first had a very strong and assertive government which protected their respective economic interests and growth by tariff walls. So it was never a free trade and free economy which was preferred by nascent states. They always preferred protected and regulated trades. They protected their indigenous markets and then only they industrialized. USA had to fight a war of independence against Britain in order to build a protected and regulated market. Meiji’s Oligarchs unified Japan and developed a strong central government to protect and regulate their trades as well as their internal market. Junkers of Germany unified the small fiefdoms and their prime minister Bismark ruled by iron and blood in order to industrialize and militarize Germany.

The lessons of Great Depression and the lessons of recurring Boom and Bust cycle hold only one lesson that we cannot afford capitalism. If we will have capitalism, the losses will be socialized and profits will always be privatized. In other words the working class will always be losers. If there is to be equity, justice and continuity of progress we will have to opt for Socialism.

In the present times large scale production and large scale service units should be professional managed with public ownership and small scale production units which require special category of traders, artisans and businessmen supervision should be owner managed and hence under private ownership.

Iraq and Afghanistan War has taken away $3 trillion from the American Public which other wise would have been used for job, health- care, housing, environment, energy and for immigrants rehabilitation. The $810 billion bail out package also was unnecessary if the American Corporates had played the games according to rules set by them only. Today 50 million Americans are without health care. But US Govt does not feel it is necessary to cover all with Health Insurance. Today US Government is the Government by the rich , of the rich and for the rich. Vast majority of people lead a marginalized life. Acknowledgment: The Author acknowledges AICTE financial support in form of 8017/RDII/MOD/DEG(222)/98-99 under MODROBS Scheme.

Author Information: The authors declare no competing financial interests. Correspondence and requests for materials should be addressed to B.K.Sharma(: bijay_maniari@rediffmail.com )

Bijay K. Sharma (Fellow of IETE-1985, Member IEEE-2007), Date of Birth: 01/07/1946, Place of Birth: Bela, District Sitamarhi, Bihar, India.B.Tech(Hons) 62-67,Electronics & Communication Department from Indian Institute of Technology,Kharagpur, India. M.S., 69-70, Electrical Engineering with specialization in Microelectronics from Stanford University, U.S.A.; Ph.D., 70-72, Electrical Engineering with specialization in Bio-Electronics from University of Maryland, U.S.A. Currently the author is working towards his D.Sc. degree in the field of Applied Mathematics, namely Celestial Mechanics, at BRA Bihar University, Muzaffarpur, Bihar, India. He worked as Junior Research Fellow at Central Electronics Engineering Research Institute, Pilani, Rajasthan, in the period 67-69. In this period he developed Tolansky Interferometer for measuring thin film thickness of the order of 200? and Nichrome Resistance of 200 ohm/square sheet resistivity with and temperature coefficient of resistance 200p.p.m per degree. In 69- |

|

economy and its currency can be helped and prevented from sinking into chaos.[13] LESSONS FROM THE SUB_PRIME DEBACLE.

Adam Smith wrote the Bible of Capitalism in nineteenth century. This was ‘Wealth of Nations’ written in late 18th century. In this he extolled the invisible hand of supply and demand and he strongly recommended that in a free market with no government regulations, this invisible hand will take care of the imbalances in commodity market as well as in share market and it will restore a balance in

References.

1. ‘Limits of Regulation’ by Omkar Goswami,

Business World, 13th October 2008, pp 38. 2. ‘Of bailouts, Public Sell outs and Media copout”, P.Sainath, The Hindu, October 7, 2008

3. ‘Anti-democratic Nature of US Capitalism is being exposed’, by Noam Chomsky, Irish Times, 12/10/2008.

4. ‘None Too Big to fall’ Srikant Sriniwas, Business World, 13th October 2008, pp. 30-32.

5. ‘Of the same Feather’, Vijay Prasad, Frontline, 24 October 2008, pp. 59-61.

6. ‘When the Bubble Burst’. By Shyam P.. Sunday Magazine, Hindu, 5 Oct, 2008, Volume 131, No. 40.

7. ‘Economic Orthodoxy was built in Superstition’ by Madeline Bunting, The Hindu, 7 October, 2008.

8. ‘Coping with the crisis’(Editorial), The Hindu, 7 October 2008.

9. ‘Global stock tumble as crisis escalates’, London Report, The Hindu, 7 October 2008.

10. ‘A good day for democracy’ by Joseph Siglitz, The Hindu, Thursday, 2 October, 2008.

11. ‘Gordon does Good’ by Paul Krugman’s Column, The Hindu, Tuesday, 14 October 2008, Vol.131,No.244,pp. 11.

12. ‘Central banks across globe pump billions of dollars into banks’, London,AFP, The Hindu, Tusday October 14, 2008, Vol.131,No.244,pp. 18.

13. ‘Financial Crisis: key role for China’, by Andrew Grahm, The Hindu, October 2008,pp13.

Appendix I.

Previous Bailouts, Hindustan (Hindi), Monday , 6 October, Patna Edition.

72, he completed his higher studies in U.S.A.. After returning to India he worked as Pool Officer in Electrical Engineering Department of Bihar College of Engineering, Patna, Bihar, India, during the period 72-73. This was sponsored by Council of Scientific and Industrial Research. From 73-80, he was engaged in grass root activism in the villages of Bihar. From 80-84, he served as a lecturer in E & ECE Department of I.I.T., Kharagpur. 84-85, he served as Assistant Professor in Electronics & Electrical Engineering Depaertment at Birla Institute of Technology & Science. 85-86, he served as Assistant Professor and Head of the Department in Electronics Engineering Department of Institute of Engineering & Technology, Lucknow, U.P. From 86 to 97, he was engaged in rural construction activities at his village home in Maniari, Muzaffarpur, Bihar, India. From Dec 97 to date he has been actively pursuing R&D in the field of Microelectronics in Electronics & Communication Engineering Department in National Institute of Technology, Patna. Presently he is in the post of Assistant Professor and Head of the Department. He has been actively engaged with the study of Planetary Satellites in his work for D.Sc. under Prof. Bhola Ishwar.

Dr. Sharma in course of his R & D work has written a series of papers on Universal Hybrid –p model which will go a long way in developing and establishing an accurate compact model for analog circuit and system simulation using BJT. In course of his D.Sc. Dr. Sharma has proposed a new theory of Solar System’s birth and evolution. With the discovery of exo-planets and their inventory increasing every day both in number as well as in diversity, Celestial Physicists are at complete loss in terms of a coherent theory which can consistently explain the diversity of exoplanets. Dr. Sharma’s theory fills the gap. Also other people’s work is corroborating the work of Dr. Sharma. |

|